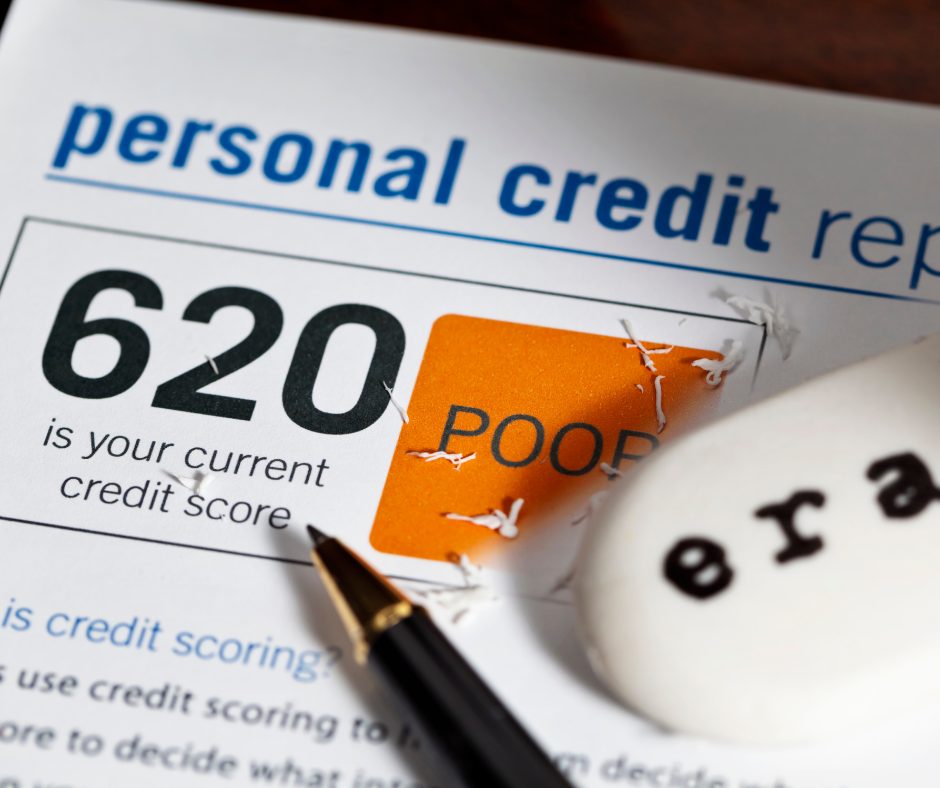

If you want to buy your first home, having a solid credit score makes a difference. Without that, you may have trouble getting a mortgage or securing a great rate, making the dream of homeownership harder to achieve.

Whether you’re interested in buying a house with no credit or are trying to figure out how to build your credit to buy your first home, here’s what you need to know.

Building Credit When You Have None

How can I buy a house with no credit? It’s a question many people ask. Fortunately, there are things that help build credit, some of which work fairly quickly. If you want to figure out how to build credit to buy a house, here are some of the best ways to build credit when you have none.

1. Secured Credit Cards

One of the easiest ways to start building a credit history if you don’t have one is secured credit cards. With these, you send a specific amount of money to a card company, allowing it to function as collateral. In return, you get a credit card with a limit that matches the collateral you sent over.

There’s an interest rate and required monthly payment like an unsecured card, but the collateral makes it easier to qualify. As a result, these cards can be a solid way to build credit when you have none.

It’s important to note that secured credit cards and prepaid cards aren’t the same things. With prepaid cards, you simply spend the money you place on the card without further obligation. As a result, the answer to the question, “Do prepaid cards build credit?” is “no.”

2. Rent Reporting Services

Does paying rent build credit? Usually, the answer to that question is “no,” unless you use a rent reporting service.

Rent reporting services submit your rental payment history to one or multiple major credit bureaus, letting your rent payments improve your credit scores. However, it’s important to note that rent reporting services come with a price tag. Additionally, your landlord may have to verify your payments, which they may or may not be willing to do.

3. Experian Boost

Experian Boost is a specialty program through Experian that allows on-time, non-credit-related payments to improve your score. For example, it may give you credit for paying your utilities on time, allowing that activity to bolster your credit score.

This service is free to use, and the results are instantaneous. However, it only impacts your Experian score, so it won’t help you if a lender uses Equifax or Transunion when it checks your credit.

4. Credit Building Apps

Apps that help you build credit are out there, but they aren’t always ideal. Many come with high fees or interest rates. Additionally, they typically can’t do anything you couldn’t do on your own using other approaches.

However, finding an app that builds credit could be worth considering if you’re genuinely stuck. Usually, they come in three forms.

First, there are credit-building loans. Technically, you don’t get a loan with these. Instead, you agree to a savings plan that has the same conditions as a loan, including a required monthly payment and an interest rate you’ll have to pay. The issuing financial services company will report your activity as if you were repaying a debt, allowing it to build your credit.

The second of the apps to build credit are the debit-as-credit versions. With these, you connect a bank account to a third-party company and its companion card, usually paying a fee for the service. Then, as you spend, the company reports your activity to the credit bureaus.

Finally, there are apps that do provide you with functional credit lines. However, these apps are highly restrictive. Some may let you build credit by paying for a subscription-like a streaming service – through its platform. Others may have you shop with a small credit line, but only through a companion store with incredibly inflated prices.

How to Fix Your Credit to Buy a House

If you’re struggling with bad credit, buying a house may be challenging. However, that doesn’t mean all is lost. If you want to figure out how to build my credit to buy a house, here are some steps to take.

1. Review Your Credit Report for Errors

You can access your credit reports – but not your score – for free by heading to AnnualCreditReport.com. The federal government authorizes that site, and it’s simple to use. Plus, while you can usually only check once per year, the credit bureaus are giving weekly access to credit reports for free during COVID-19, giving you more opportunities.

When you review your reports, you may notice mistakes that are hurting your credit score. If you’re wondering, “Where can I dispute my credit report?” the answer is “through the credit bureaus.” Each one has its own dispute process. You can find out about each one online by heading to the following sites:

If you want to see your actual scores, you may have access through an account you have open. Many lenders – particularly credit card issuers – let customers view their credit scores for free, making it the easiest option. Otherwise, you can use apps like Credit Karma or Credit Sesame.

Just be aware that the free score may be a VantageScore and not a FICO, and the two aren’t the same thing. Usually, lenders use FICO scores to make loan decisions, so getting access to that is preferable. However, monitoring your VantageScore can still be beneficial, as upward movement with one score usually means the same is occurring with the other, and vice versa.

2. Don’t Add More Debt

If your credit score is low because of the amount of debt you carry or issues making on-time payments, don’t add more debt to the equation. Stop using any revolving credit – such as credit cards or lines of credit – immediately, ensuring those balances don’t grow. While you may need to revamp your budget to eliminate debt-based spending, it’s a necessity if you want to get back on track.

Similarly, don’t open any more credit-based accounts. Hard inquiries do impact your credit score, dropping it down for a period of up to two years, depending on how many you have on your report. By not applying for new credit, you won’t have to worry about that either.

3. Make On-Time Payments a Priority

Your payment history is the biggest factor when calculating your FICO score. If you want to see your score rise, on-time payments are essential.

Set up automatic payments for the minimum amount due each month. That way, you won’t miss a payment. Then, if you want to pay down a debt faster, make an extra payment manually, leaving the automatic one intact.

4. Reduce Credit Card Debt

Your credit usage is another huge factor when it comes to your credit score. By reducing your utilization ratio – the amount of credit you use in comparison to your credit line – your score usually rises.

Ideally, you want to get your utilization to 30 percent or below. However, if you’re trying to figure out how to increase your credit score to 800, then 10 percent is a better target.

Credit Repair – What You Need to Know

In many cases, credit repair companies market themselves as near-magical ways to fix your credit. The thing is, they can’t do anything you aren’t able to do on your own. Additionally, they may charge high fees for the service, and some entities operating in this space are outright scams.

While the Federal Credit Repair Organizations Act (CROA) aimed to halt certain unfair or deceptive marketing practices relating to credit repair companies, that doesn’t mean all companies are highly straightforward about what their services can do. Additionally, scam organizations aren’t going to worry about the CROA act, as they’re already violating the law.

Before you try a credit repair company, spend time fixing any incorrect items on your credit report on your own. Usually, all a credit repair organization will do for you is dispute errors on your behalf. By doing it yourself, you’re eliminating the need for their help while saving yourself money.

Additionally, learn about credit repair scams warning signs. Lofty promises – especially if they’re positioned as “guarantees” – are a big one. The same goes for large upfront fees that you’re pressured into paying or saying that they can remove negative points on your credit report that are legitimate, which isn’t actually possible.

If you need financial guidance and are struggling to repay your debts, consider contacting a reputable credit counseling organization. They can assist you with budgeting or can set up debt management plans with your lenders to get you on track to conquer your debt.